What is the Charities (Amendment) Act 2024?

In July of this year, the Government passed the Charities Amendment Act 2024. This Act, which introduces a range of amendments and updates to the Charities Act 2009, the Charities Act 1961, and the Taxes Consolidation Act 1997 respectively, amounts to a wide-reaching reform of charity governance. The Act has also expanded the powers of the Charities Regulator with a view to ensuring that financial regulation of the charities sector, as well as regulation of the sector broadly, can be conducted on an appropriate basis.

The Amendment Act is an extensive document and contains 38 separate amendment areas. Tracking these amendments across the Acts will be a complex process. In this article we go through a few key areas covered in the Act, including:

- Duties and definitions of trustees

- Financial regulations

- Role of “Human Rights” in charity sector

- Charities Regulator

What are some key changes?

Trustee Definitions:

Under the Amendment Act, new definitions of who counts as a charity trustee and what their duties are, have been established. Section 3A of the Act makes explicit that a company secretary is not considered to be a charity trustee, unless they are also a Board member or sit on the governing body. This clarifies an ambiguity in the previous Act. The Act also sets out the duties falling to charity trustees. The duties include requirements to act in good faith for the charity’s best interests and to avoid conflict between personal and charity interests.

Financial Reporting:

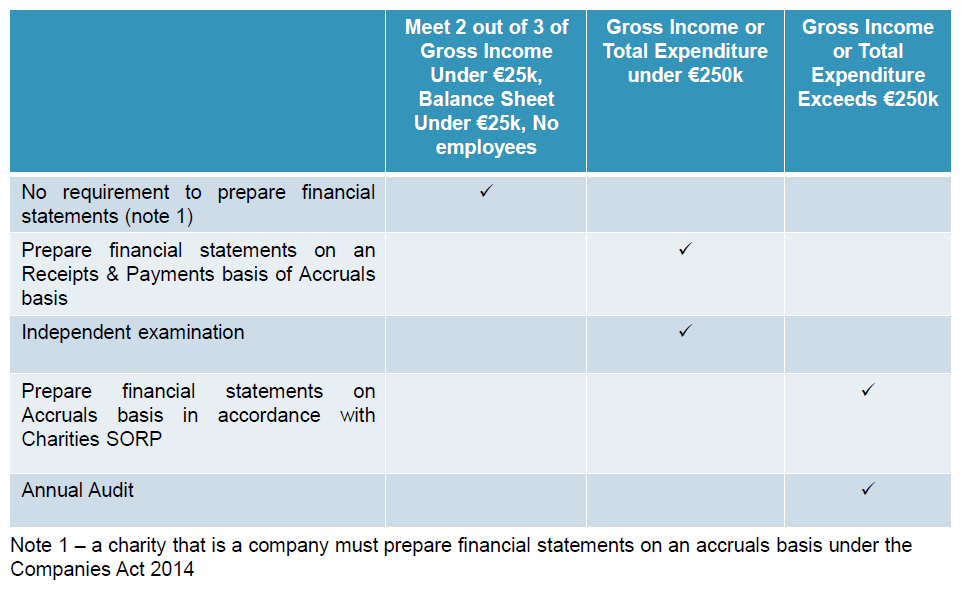

There have been a range of changes to how charities must conduct financial reporting. Reporting thresholds and exemptions have been moved or redefined, new regulations have been introduced, and new alternative reporting methods are now available.

For instance, a charitable organisation, that is not a company and which also falls below a gross income or expenditure threshold of €250,000, is no longer obliged to prepare a statement of accounts. Such an organisation may instead prepare an income and expenditure account in respect of, and a statement of the assets and liabilities of, the charitable organisation.

On the other hand, a charitable organisation that is a company must now prepare financial statements in accordance with the Companies Act 2014.

Many of the financial reporting requirements included in the Amendment Act are similar to the requirements of the Charities SORP (Statement of Recommended Practice). However, the Charities SORP is not explicitly referenced in the Amendment Act and so Charities are not currently required to meet it. Charities should continue to be aware of the Charities SORP, as the Amendment Act does leave room for further regulatory changes that could include introducing the Charities SORP.

Definition of Charity:

The new Act provides an expanded definition of the activities which can be considered to be done for a charitable purpose. The phrase “any other purpose that is of benefit to the community” which was previously used in this definition has been replaced by a list of fourteen (14) activities. These include, for example, protection of the natural environment and the advancement of human rights. Organisations engaged in these activities will now count as charities.

Charities Regulator:

The Charities Regulator has also acquired new powers under the Amendment Act. Any Charity wishing to change its constitution, for example to alter its charitable purpose or its income and property clause, must now apply to the Regulator.

New powers of enforcement and punishment have also been provided to the Regulator, where a Charity fails to meet the new requirements.

What should you do to respond?

The changes brought about by the Amendment Act are extensive and will require adjustment from Charities. Listed below are some actions you may consider taking now to help ease the transition into the new regulatory environment:

Are you a Charity?

Bodies should review the new definitions of what is considered a charity. The Act requires that any organisation that becomes a charitable organisation by virtue of these new definitions must apply to the Regulator to register as a Charity within six months. In turn this will also require that organisations now falling under the Charity Act may have to amend their internal organisation to meet the Act’s requirements.

Who are your trustees?

Changes to the definitions of who is and is not a trustee will require charities to update their register of trustees and other governing documents to account for this.

How do you conduct financial reporting?

Charities should review the amended requirements for financial reporting and determine where they fall on the new thresholds for reporting. For instance, the Amendment Act has raised the threshold requiring that the accounts of a charitable organisation be audited from €500,000 to €1,000,000. On the other hand, while the previous Act exempted a charitable organisation that is a company from this audit requirement, this exemption has now been removed.

Conclusion

Tracking these amendments will be pressing work. It should be noted as well that these requirements are coming into effect immediately. The deadline to register as a charity, under the new definitions, is already approaching.

Crowleys DFK are on hand with their subject matter specialists to provide expert guidance and support in maintaining compliance with the Amendment Act. Please contact us for further information.